Haynesville Mineral Rights

ABOUT THE HAYNESVILLE SHALE RESOURCES

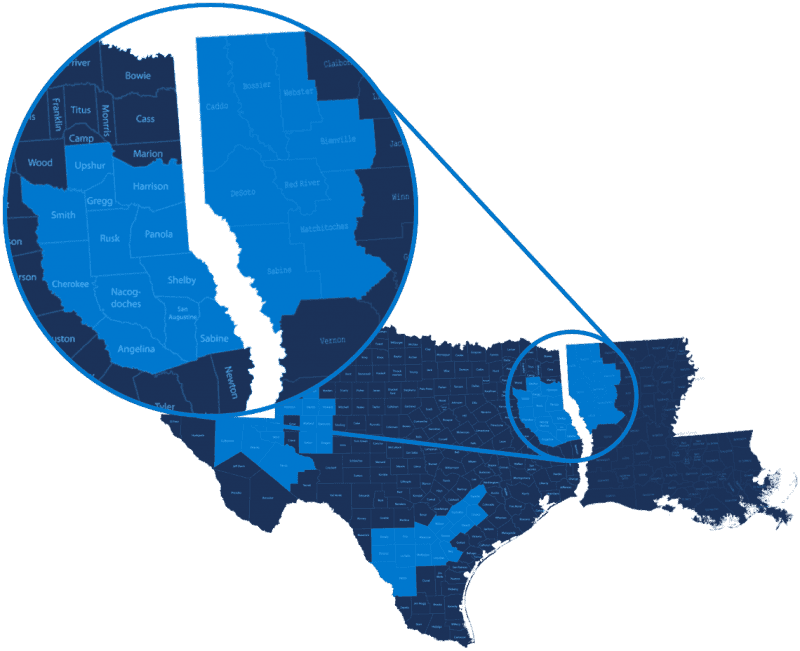

The Haynesville Shale is a massive dry natural gas formation that that can be found over a large area of Northwest Louisiana and East Texas at a depth of between 13,000 and 14,000 feet. In essence, it is a sizable subterranean shale deposit that is rich in natural gas.

The play was commercialized by Chesapeake Energy in 2008 and is primarily located in Sabine, Shelby, Panola, Harrison, Gregg, Rusk, Nacogdoches, San Augustine, Cherokee, Angelina, Smith, and Upshur counties in Texas and Caddo, De Soto, Sabine, Bossier, Red River, Natchitoches, Bienville, and Webster parishes in Louisiana.

The Haynesville Shale, once considered too expensive to explore, has sparked a flurry of activity due to advanced technology, procedures, and rising energy prices. In addition to increased interest in The Haynesville Shale, the value that landowners can get when selling leases has sharply risen.

WHY SELL HAYNESVILLE SHALE MINERALS TO MOMENTUM MINERALS?

The Louisiana NARO Chapter, a vital resource for Louisiana mineral and royalty owners, was founded by Momentum Mineral's CEO James Elder. James established the Louisiana NARO Chapter to promote the interests and rights of Louisiana mineral and royalty owners through advocacy, education, and support.

With Momentum Minerals' experience actively buying mineral rights and oil & gas royalties in the Haynesville Shale, we are able to value your mineral, royalty and overriding royalty interests and purchase those assets at a competitive price. You'll receive a lump sum upfront, allowing you to realize the value of your asset today. We work with individual property owners and consortiums in counties and parishes throughout Haynesville.

Have mineral rights ready to sell in the Haynesville Shale?

If you are interested in selling your mineral rights, call today to see how we can help. We pride ourselves on our integrity – you can be assured that Momentum will provide the most accurate valuation, offer you a fair market price for your assets, and close promptly. Momentum Minerals purchases your minerals and royalties. We do not offer leases. Our assessment of the productivity of your resources is based on technical analysis and what we believe to be a fair, competitive price. Call us today to see how we can help you realize the value of your assets in the Haynesville Shale.

Mineral Rights Today?

Process before Selling?

Why Choose Momentum?

Your Mineral Rights Buyer

Momentum Minerals has experience in evaluatingand purchasing the mineral rights, royalties and overriding royalties for shale resources throughout the United States. We work with you throughout the process to make sure that you understand how we value your assets and the price you are receiving is fair and competitive. Our capital partners ensure that we have the funds to offer the best price today and close quickly for large and small assets.

There are three primary types of Mineral Rights. Momentum Minerals, we can help you determine what type of rights you own:

Mineral Rights

Mineral rights grant ownership to all of the oil and gas lying below the surface of the property, as well as the right to explore, drill, and produce oil and natural gas on that property or to lease such rights to a third party. Typically, mineral rights are perpetual.

Overriding Royalty Interests (ORRI)

Overriding royalty interests are royalty interests that burden the working interests of a lease and represent the right to receive a fixed percentage of production or revenue from production from a lease. Overriding royalty interests are non-perpetual, and the right to develop minerals reverts to the mineral owners when the initial lease term expires.

Nonparticipating Royalty Interest (NPRI)

A non-participating royalty interest owner has a right to all or a portion of the royalty from gross production, but does not have the right to execute a lease, receive a bonus or any delay rentals. An NPRI owner also does not have the right to produce the minerals by himself, and they are not responsible for the operational costs associated with production or drilling. An NPRI has fewer rights than a ‘regular’ mineral rights owner as they do not have the right to make decisions related to the execution of leases. Other mineral rights owners generally participate in at least one of the previously mentioned activities.

When looking to sell your mineral rights to a buyer, Momentum is a superior choice. We work with all acreage amounts, from a large consortium to individuals. We will inform you of how we value your assets, as well as why selling your assets may be the best choice for you. Momentum is committed to closing a purchase in a quick, efficient manner that considers the location, market value, size, and productivity of your mineral assets. No matter where your mineral rights are located, our acquisition specialists will quote a fair, competitive price.

Momentum is committed to closing a purchase in a quick, efficient manner that considers the location, market value, size, and productivity of your mineral assets. No matter where your mineral rights are located, our acquisition specialists will quote a fair, competitive price.

Momentum Minerals works with all types of acreage, whether producing or non-producing, and with all acreage amounts, from large consortiums to individual mineral owners.

Give us a call at 713-633-4900 or fill out our Request an Offer form in order to take the first step towards getting your offer.

We will gather information needed for mineral rights analysis.

Review and analyze the value of your assets to make an offer.

Review and analyze the value of your assets to make an offer.

Recieve an offer, agree on price & schedule a closing date.

Recieve an offer, agree on price & schedule a closing date.

Have a Question?

Send us a message and our team of mineral acquisition experts will get back to you shortly.

Suite 420

Houston, TX 77024

Suite 420

Houston, TX 77024